estate tax exemption 2022 proposal

This is the amount that was increased by the TCJA from 5M. The tax rate for affected wealth transfers would be 40 according to the provision summary.

Top Estate Planning Law Changes For 2022 Law Offices Of Daniel Hunt

The 2022 exemption is the largest in history but it wont last.

. The Proposal reduces the current 11700000 per person unified gift and estate tax exemption by approximately one half to approximately 6030000. 11700000 in 2021 and 12060000 in 2022. The effect of the change would be to reduce the basic exclusion amount for estate.

Estates of decedents survived by a spouse. The gross receipts tax is much like a Value Added Tax only for businesses rather than individuals. AUSTIN Texas Travis County property owners can now review proposed tax rates and the impact they could have on their 2022 property tax bills online at.

Fisher Investments has 40 years of helping thousands of investors and their families. The gift tax exemption will be limited to 1000000 beginning on January 1 2022. Four states impose gross receipt taxes Nevada Ohio Texas and Washington.

Exemptions lower the amount. Subjecting grantor trusts to estate tax. SACRAMENTO CA Yesterday the California State Senate passed SB 1357 provides tax relief for disabled veterans throughout California.

The 2022 federal estate exemption is at an all-time high increasing from 600000 in 1997 to 1206 million today. 1 day agoFiled this week the measures would nearly double the maximum income eligibility level for the Senior Citizens and Persons with Limited Incomes and Disabilities property tax. In late January 2022 the Baker-Polito Administration filed a comprehensive tax proposal which would make several changes to the Massachusetts estate tax including by.

Ad Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios. On Trumps taxes Deutsche Bank has revealed that it possess two individual tax returns that are covered under House committee subpoenas regarding Trumps finances. The Department of Finance administers a number of property related benefits including in the form of Exemptions and Abatements.

Basic Exclusion Amount BEA this amount is the lifetime exemption amount for taxable estate and gift taxes. Proposed Estate Tax Exemption Changes. Decrease of Valuable Estate and Gift Tax Exemptions Effective January 1 2022 Time is now of the essence for utilizing gift and estate tax exemptions.

The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to 5 million. The proposals reduce the federal estate and gift tax exemption from the current 117 million inflation-adjusted for 2021 to 5 million inflation-adjusted effective January 1. The good news is that.

The Proposed Regulations provide an exemption from the favorable treatment provided in the Anti-Clawback Regulations under Section 202010-1c for certain completed. Those changes include. But for taxpayers who do not plan properly this could mean an increase in state death.

The federal estate tax exemption increases from 2 million to 35 million for deaths occurring in 2009. Presently the estate tax and gift tax exemptions are both set at 11700000 less whatever. For 2022 the federal estate and gift tax exemption stands at just over.

The measure introduced by. Reducing the estate and gift tax exemption to 6020000 effective January 1 2022. The American Families Plan the Plan proposed by President Joe Biden makes several changes to tax laws including the amount of.

Get information on how the estate tax may apply to your taxable estate at your death. The window for you and your family to transfer wealth to heirs and charities is wide open right now.

Proposed Impactful Tax Law Changes And What You Can Do Now Johnson Pope Bokor Ruppel Burns Llp

Biden Greenbook Estate Tax Proposals Should You Care

Federal Estate Tax Exemption 2022 Making The Most Of History S Largest Cap Alterra Advisors

Current Status Of Federal Estate And Gift Tax Proposals Ruder Ware Jdsupra

Consider Wealth Transfer Strategies In Advance Of Proposed Tax Law Changes Mariner Wealth Advisors

Green Book Details President S Tax Reform Proposals Center For Agricultural Law And Taxation

Dof Urges Marcos Postpone Income Tax Cuts Slap New Taxes Slash Vat Exemptions

Here S How Capital Gains Tax Changes Could Impact Your Clients Estate Planning For 2022 Vanilla

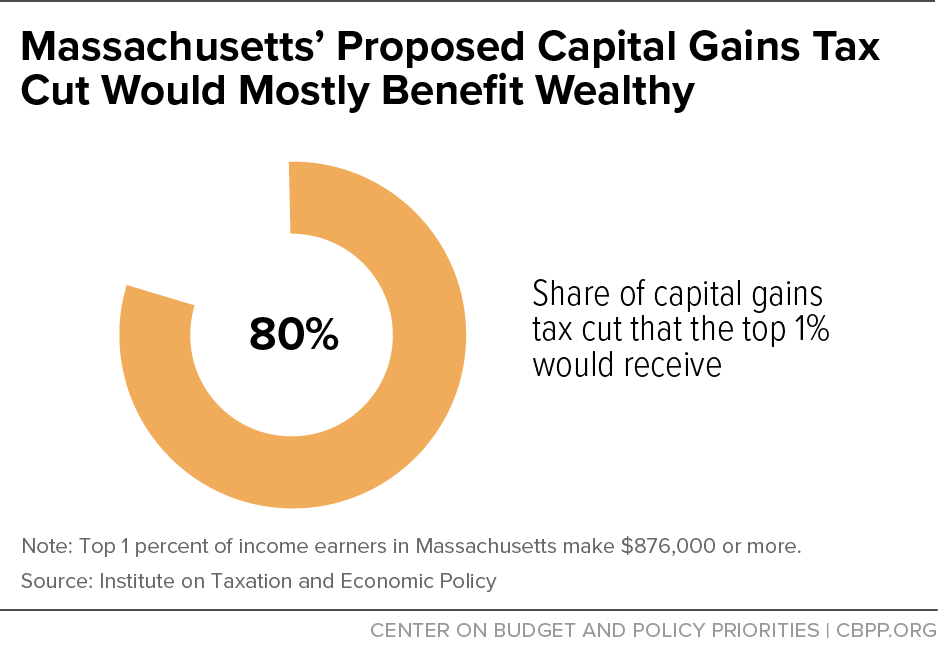

Massachusetts Should Focus On Building An Equitable Recovery Not Tax Cuts For The Wealthy Center On Budget And Policy Priorities

New Estate And Gift Tax Laws For 2022 Lion S Wealth Management

What Happened To The Expected Year End Estate Tax Changes

Dof Urges Marcos Postpone Income Tax Cuts Slap New Taxes Slash Vat Exemptions

No Expected Estate Tax Exemption Increase Under The Build Back Better Legislation

Potential Impact Of Estate Tax Changes On Illinois Grain Farms Farmdoc Daily

Tax Proposals Under The Build Back Better Act Version 2 0

Green Book Details President S Tax Reform Proposals Center For Agricultural Law And Taxation

Unprecedented Changes Proposed To Gift And Estate Tax Laws Barnes Thornburg

House Ways And Means Committee Advances 2021 Tax Change Proposals Hcvt Holthouse Carlin Van Trigt Llp