fsa health care limit 2021

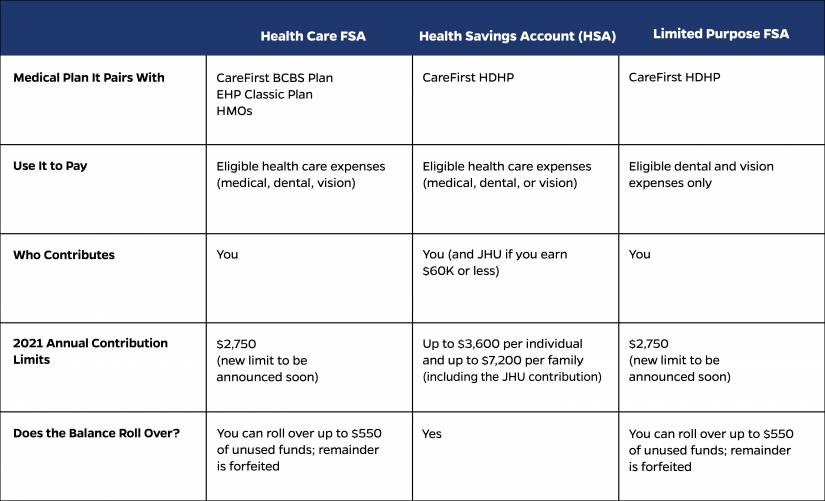

Use flexible spending accounts to pay for health care and dependent care while saving money on your taxes. A DCFSA is an account that lets you use pre-tax dollars to pay for eligible dependent care expenses.

Healthcare Fsa Vs Hsa Understanding The Differences Forbes Advisor

HSA Health Savings Account.

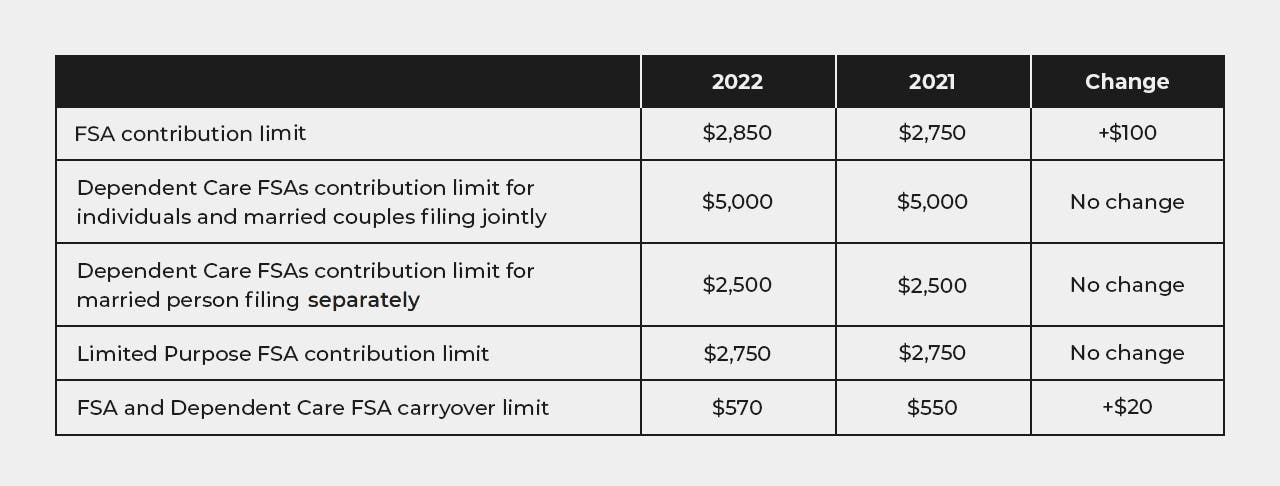

. This can certainly be confusing how this all works. For 2022 you can contribute up to 2850 to an FSA. Why to consider enrolling in an FSA.

Healthcare and Limited Purpose FSA 2021 2022. Pinnacle offers a full suite of health and benefits accounts including HSAs FSAs dependent care and commuter. FSA Flexible Spending Account.

These FSAs are designed specifically for expenses related to dental and vision care. The maximum limit for the Dependent Care FSA is 5000 per household or 2500 if married and filing separately. Product availability varies by group size.

An FSA allows you to pay certain expenses from your pre-tax income rather than after-tax income. What is a dependent care flexible spend account. Check with your employer before choosing your contribution amount.

The 16000 limit would be used to compute your credit unless you have already excluded or deducted dependent care benefits paid to you or on your behalf by your employer. Dependent Care Flexible Spending Account FSA. The most you can contribute pre-tax to your account is 2750 in 2021 which is unchanged from 2020.

A health FSA may allow an individual who ceases participation in a health FSA during calendar year. Individual and family limit 4. You can apply for a Dependent Care FSA to cover and save on costs for child day care or adult day care.

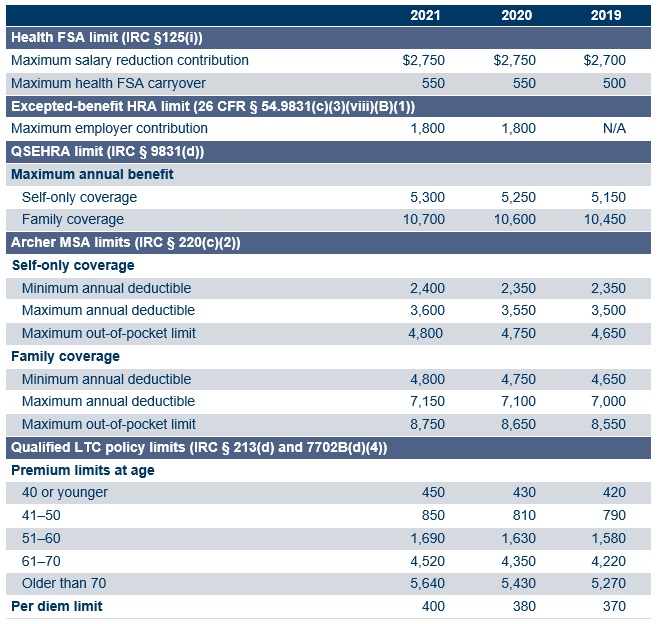

A health savings account HSA a health reimbursement account HRA healthcare and limited-purpose flexible spending accounts FSAs a dependent care FSA and commuter benefits. The contribution limit was 2750 in 2021. Plan year ending in 2021 and from a plan year ending in 2021 to a plan year ending in 2022.

DSHS Community Services Division PO. Sept 3 2021. Does your balance in an HSA or FSA roll over to the next year.

Box 11699 Tacoma WA. Married and filing jointly or single parent. A health FSA may extend the grace period for using unused benefits for a plan year ending in 2020 or 2021 to 12 months after the end of the plan year.

HRA Health Reimbursement Arrangement. The 2021 dependent-care FSA contribution limit was increased by the American Rescue Plan Act to 10500 for single filers and couples filing jointly up from 5000 and 5250 for married couples. Dependent Care FSA 2021 2022.

Print out and complete Form 18-005Mail the form to the Washington State Department of Social and Health Services DSHS. The income standards listed in these examples are subject to change annually every January. Your employer may not allow you to contribute as much as the IRS allows.

Annual limit - 5000 per household up to 2500 per spouse for. In this situation you should list 16000 for the 3-year-old child and -0- for the 11-year-old child. Dependent-care Flexible Spending Accounts FSA let employees use tax-exempt funds to pay for childcare expenses they incur while at work.

The annual contribution limit for these accounts is also capped at 2750. The child and dependent care tax credit increased under the American Rescue Plan for the 2021 tax year of up to 4000 in qualifying dependent care expenses for one eligible child or up to 8000 for two or more eligible children. With Anthem Spending Accounts you can choose from five benefit or account types to offer.

Applying for Apple Health coverage.

Hsa Vs Fsa Millennium Medical Solutions Inc Healthcare

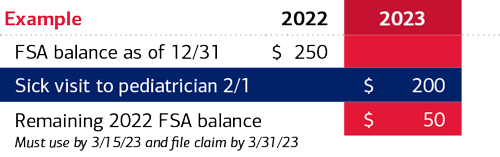

Understanding The Year End Spending Rules For Your Health Account

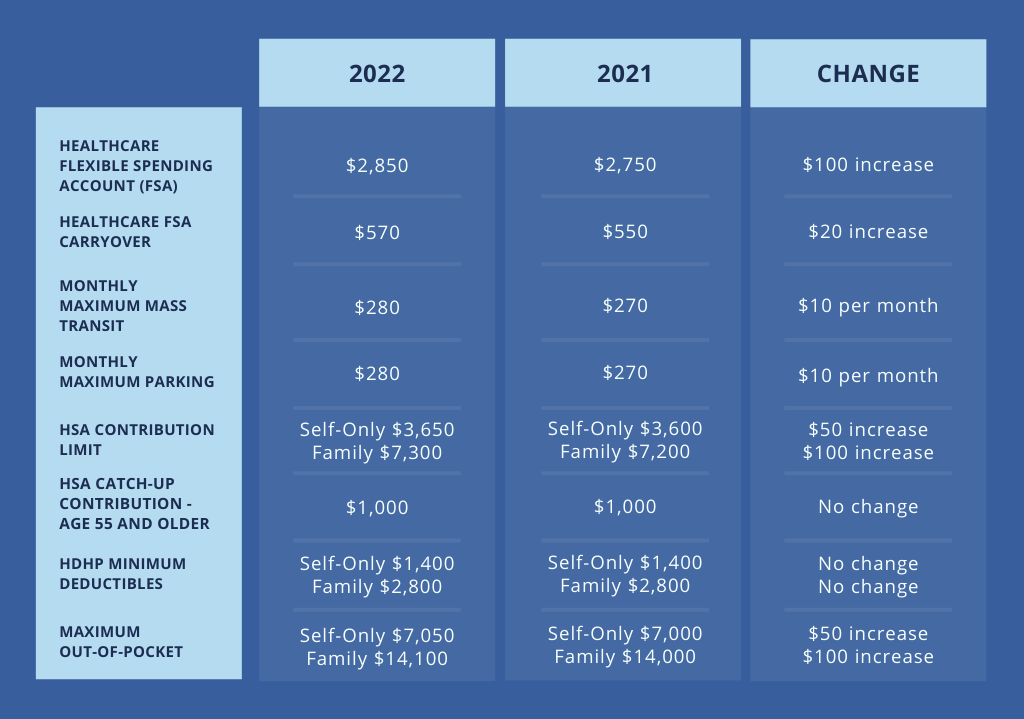

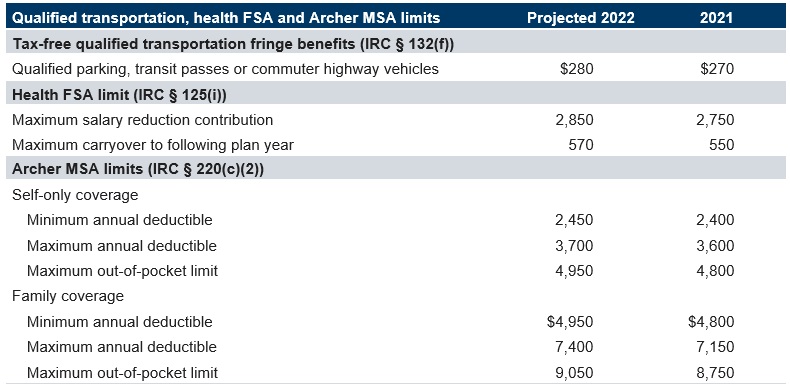

2022 Limits For Fsa Hsa And Commuter Benefits Rmc Group

Irs Adjusts Health Flexible Spending Account Other 2022 Limits

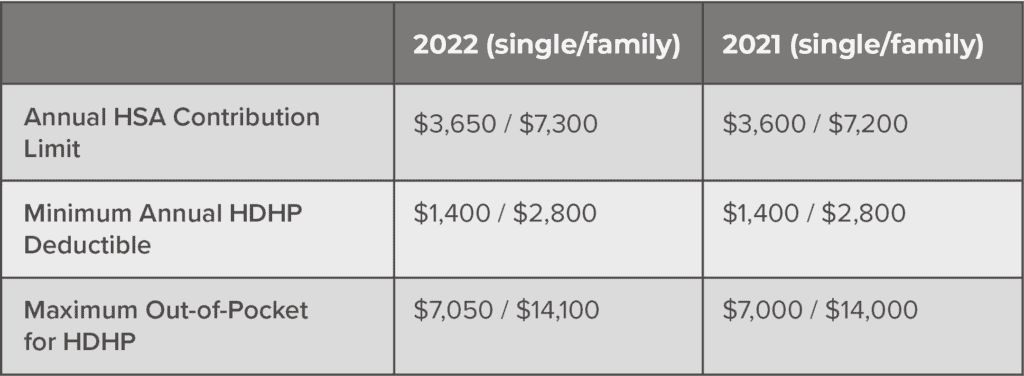

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

2022 Limits For Fsa Commuter Benefits And More Announced Wex Inc

2021 Health Fsa Other Health And Fringe Benefit Limits Now Set Mercer

Healthcare Hsa Vs Fsa Understanding The Difference Alliance Health

Fsa Carryover Lawley Insurance

Fsa And Hsa Limits In 2022 What S Changing Sportrx

Irs Announces Fsa And Parking Transit Limits For 2021 24hourflex

Sterling Administration Year End Hsa And Fsa Tips And Reminders Claremont Insurance Services

2022 Transportation Health Fsa And Archer Msa Limits Projected Mercer

Hsa Vs Fsa Millennium Medical Solutions Inc Healthcare

Lower Your Taxes With Spending Accounts Hub

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

2021 Transportation Health Fsa And Archer Msa Limits Projected Mercer

2021 Health Fsa Other Health And Fringe Benefit Limits Now Set Mercer

Irs Announces 2021 Health Fsa Qualified Transportation Limits Lyons Companies